News & Notices

Join Our Email List For TCCU news and important notifications.

2024

Critical My TCCU Cards Mobile App Update Needed

If you use the My TCCU Cards app to protect your TCCU debit and/or credit cards, we’ve been notified by the developer that you must update to version R37 or newer by August 5, 2024. If you do not process the update, you will lose all functionality of the app.

This upgrade is essential to enhance security features and protect against potential hacking. Older versions of the app will be discontinued to ensure your information remains secure.

If you do not have automatic updates enabled, visit the app store on your device and update the app to the most recent version. Future mobile releases will alert you directly with an in-app notification.

If you don’t yet use the app, we encourage you to do so. Click here for more information on the My TCCU Cards app. Reach out to us if you have any questions regarding this important security upgrade.

English & Spanish Communications

Marketing and member-communications from the credit union will now be offered in English and Spanish for the convenience of our members and the diverse community we serve.

BALANCE Webinar for the Win Sweepstakes

We are participating in BALANCE’S 6th Annual Webinar for the Win Sweepstakes!

Contestants (you) are getting an extra incentive to attend these free, educational webinars. One lucky attendee will win the $1,000 GRAND PRIZE!

The rules are simple. To enter, you must register and attend one of the free webinars held in February, March or April (and stay for the whole thing). Webinars are live, online sessions that let people learn from and interact with an expert on today’s most popular financial topics.

(Pro tip: Attending additional webinars earns you extra entries into the contest.)

February, “Solving the Mystery of Credit Reports”

February 13th and 22nd

Register: bity/SolvingMysteryofCreditReports2024.l

March, “Saving with Purpose”

March 12th and 21st

Register: bit.ly/SavingwithPurpose2024

April, “Teens and Money”

April 9th and 18th

Register: bit.ly/TeensandMoney2024

Official Rules Webinars for the Win

2024 Annual Meeting Date Set

Thursday, March 28, 2024 | 6:30 P.M.

Thursday, March 28th is the date for this year’s Annual Business Meeting. We are offering both in-person and virtual options for members to attend this business meeting. Please RSVP by email to Monica Garcia or call her before noon on 3/22/2024. RSVP’s are required for either option. Monica Garcia | mgarcia@tccu-tx.com 817-884-1470 x 140

If you plan to join us in person, the meeting will be held on the 3rd floor of the Tarrant County Plaza Building. If you have any questions or need additional information, please don’t hesitate to get in touch with Monica. We look forward to seeing you there!

Free Tax Filing Assistance

Update | April 11, 2024: We are no longer accepting appointments for this tax season. See you next year!

IRS-Certified TCCU staff volunteers will be providing FREE tax preparation through VITA, weekdays – by appointment only, at our Tarrant Plaza branch, located at 200 Taylor Street, Suite 215. VITA is a Volunteer Income Tax Assistance Program.

VITA offers free basic tax return preparation to qualified individuals. VITA at this location is available to TCCU members and non-members, alike.

This tax service is for people who generally make $64,000 or less, so please see a professional preparer for assistance with complicated returns.

TCCU does not offer tax advice.

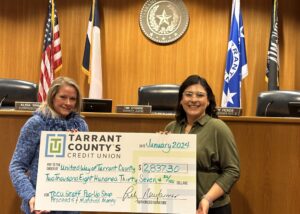

TCCU Pop-Up Shop Nets Generous Donation

Leading up to the Christmas holidays, TCCU staff held several craft Pop-Up shops to raise money for the United Way of Tarrant County. All items in the shop were handmade, either by a staff member, or by someone in their immediate family. Sellers donated 10% of all sales, and TCCU matched all total sales 100%. Including generous donations, we were able to present a check to the United Way of Tarrant County in the amount of $2837.30 on Tuesday, January16, 2024.

Introducing Medicare Plan Assistance; Free Educational Webinar

Insurance Professionals Group

480-331-7974

Choosing the right Medicare coverage is essential to ensure that you have the necessary healthcare support for your individual requirements. But knowing what plan to choose can be overwhelming.

TCCU has partnered with Insurance Professionals Group to bring you access to expert advice and guidance on navigating the intricacies of Medicare insurance plans.

These professionals have the expertise to guide you through a step-by-step process of selecting the best Medicare plan, which can help you save money and get comprehensive coverage that meets your needs.

You’re invited to attend a free educational Medicare webinar to help you learn about your Medicare options and determine what is important when enrolling in Medicare. Whether you are turning 65 or looking ahead to your Medicare options, we will highlight important information that will help you find the best coverage. Choose a date below and register today!

February 21, 2024

1:00 PM CST

Registration Link: https://us02web.zoom.us/webinar/register/WN_6etkzTU4RkiUnAzQg3Xovg

February 22, 2024

6:00 PM CST

Registration Link: https://us02web.zoom.us/webinar/register/WN_E4cjTOcTS8eKpmLgWT8lWA

This is an educational event only. There is no obligation to enroll. This is not a solicitation, and no salesperson will call you based on your participation in this event. For accommodations of persons with special needs, call 480-331-7974 (TTY: 711).

2023

Did You Miss the Webinar?

If you missed the Life Stage Investing webinar held a couple of weeks ago, we have the recorded session available for you to view right here; https://www.youtube.com/watch?v=oYGAZYvghYw

Life Stage Investing webinar - Back by Popular Demand

Free – Life Stage Investing webinar is coming soon!

Speaker: Tim Mangus, Financial Advisor

Wednesday, November 15, 2023

2:00 PM, Via ZOOM

At every life stage, you have competing priorities for how to spend your money. In your early working years, you may be focused on paying down college debt or saving for a mortgage. In the middle of your career, you may be saving for a child’s college education or remodeling your home. And, as you near retirement, you may be more concerned about how to make your savings, Social Security, and other sources of income last for 20 to 30 years.

Wherever you are on your retirement path, this informative, interactive presentation will provide information on how to:

- Save for the long term;

- Identify sources of retirement income and gaps;

- Understand your Social Security options; and

- Explain health care decisions you’ll need to make when you become eligible for Medicare.

Register today to find out some ways you can align your assets with your aspirations.

TCCU membership is not required. We hope you can join us!

Register in advance for this webinar: https://us02web.zoom.us/webinar/register/WN_SNzEvmfWQRqE07UhPwghhg

TCCU Nominating Committee Names Candidates

November 22nd Deadline for Submitting Additional Nominees

The Nominating Committee appointed by TCCU’s Board of Directors, has submitted incumbents, Alan Thomas, Craig Maxwell, and Tom Spencer, for election to the Board of Directors for 3-year terms.

If you wish to nominate a candidate, you must make arrangements to pick up a petition packet by contacting Monica Garcia at 817-884-1470 x 140, on or after October 9th, 2023. The petition packet may be picked up at the credit union’s main office at Tarrant County Plaza, located at 200 Taylor Street, Suite 215. Upon the return of the completed petition packet, a member of TCCU management must validate the petition. The petition must be signed by 1% of the voting membership. Those members must be in good standing with the credit union, and age 18 or older. Completed petition packets must be submitted to the credit union’s main office at Tarrant County Plaza no later than November 22, 2023. The nominee must submit a signed statement, along with the petition packet, that he or she is agreeable to the nomination and will serve if elected.

Wills & Trusts Virtual Workshops - August 9th & 16th

Join Tarrant County’s Credit Union & PFG Wills & Trusts Document Preparation as we introduce estate planning services to our members.

We invite you to attend the upcoming free, no-obligation virtual workshop designed to help you prepare for the unexpected.

Have you thought about:

- What if something happens to me? Are my loved ones protected?

- Should I have a plan in place for the future?

- Who will take care of my children if something happens to me?

- Who will make health care or financial decisions if I’m unable to do so?

- Do I need to set up a WILL or TRUST? Where do I start?

We know that planning for the unexpected is more important than ever, so we are here to help provide the resources you need.

*UPDATE* We will offer additional workshops in the near future. Meanwhile, you may listen to the recordings from the August 9th and August 16th sessions here:

|

8/9/2023 |

https://attendee.gotowebinar.com/recording/4139777160348157022 |

|

8/16/2023 |

https://attendee.gotowebinar.com/recording/690244146311114588 |

PFG Wills & Trusts Document Preparation operates under the direction and supervision of a Phocus Law estate planning attorney licensed in the states of Arizona and California (AZ Bar No. 028285, CA Bar No. 329214). Webinars and presentations are for educational purposes only and do not constitute legal advice. Participants do not have an attorney-client relationship with presenters without additional written confirmation. PFG Wills & Trusts Document Preparation, Phocus Law and Tarrant’s County Credit Union are separate entities. Estate Planning Services are not insured by the NCUA and have No Credit Union guarantee.

An Exciting New Checking Account Product is Here

For many years we’ve looked for a checking account product that would offer true value to our members, and we finally found it! Beginning July 5th, Standard PLUS Checking becomes TCCU’ s featured checking account. This new account is loaded with valuable benefits designed to save you money on everything from identity theft services to health services and even cell phone protection.

You’ll still get the free benefits you’re accustomed to, like:

- Complimentary online banking

- Complimentary e-statements

- Complimentary debit MasterCard®

- No fee for withdrawals at TCCU ATMs

- Thousands of fee-free ATMs nationwide

In addition, you’ll receive all of these NEW benefits and services for as low as $6 a month:

- Identity theft protection with credit file monitoring

- Cell phone protection that can replace coverage from your carrier

- Travel and leisure discounts

- Telehealth service with zero copays

- Shopping rewards

- Health discount savings (vision, prescription and dental)

- Up to $5,000 of 24-hour accidental death and dismemberment insurance

All of your account information and the way you access your account stays the same. The monthly service fee will begin August 1, 2023. The fee starts at $10 a month, but you’ll get one dollar off for each of the following:

- You’ve been a TCCU member 2+ years

- You have direct deposit into your Standard PLUS Checking account

- You have an active debit card on your Standard PLUS Checking account

- You’re enrolled in eBanking

Benefits like the cell phone protection and Telehealth more than pay for the small monthly fee on this account. (It’s less than 2 drinks from Starbs!) If you’d prefer to stay in your current checking account product please call or text us at 817-884-1470, and we’ll find the account that better suits your needs.

Your Money is Safe with TCCU

In the wake of the two recent bank failures in the U.S., we want to assure you that your deposits are safe at Tarrant County’s Credit Union.

Not only is TCCU sound and well capitalized, we reinvest member deposits into our communities via consumer and small business loans. We don’t reinvest member deposits in risky, long-term investments in search of a higher rate.

Tarrant County’s Credit Union is federally insured. Each credit union member has at least $250,000 in total coverage through the National Credit Union Share Insurance Fund, administered by the NCUA. The share insurance fund was created by Congress to insure members’ deposits in federally insured credit unions.

- Additionally, all joint owner accounts are combined and insured up to $250,000.

- The Share Insurance Fund also separately protects members’ IRA and KEOGH retirement accounts up to $250,000 and provides additional coverage for members’ trust accounts (accounts with Payable on Death beneficiaries).

- The Share Insurance Fund has the backing of the full faith and credit of the United States.

- Credit Union members have never lost even a penny of insured savings at a federally insured credit union.

There are multiple ways in which to structure your account to increase the insurance coverage on your deposits. Our Member Service Representatives can help you maximize your insurance coverage. If you have questions or are concerned about the share insurance on your account, please call us at 817.884.1470.

We’re grateful to be able to serve the members of Tarrant County’s Credit Union and appreciate your continued support and confidence. In the wake of these unsettling times, it’s crucial to have a trusted and valued partner looking out for your best interest.

Working together, toward common goals, will ensure our members’ and our Credit Union’s success for years to come.

Lily Newfarmer, I-CUDE, SCMS

President and CEO

Tarrant County’s Credit Union

5th Annual Webinar for the Win Sweepstakes

| The 5th Annual Webinar for the Win Sweepstakes is here! Attend one of our BALANCE webinars and enter for a chance to win $1,000! Our webinars are live, interactive, and include a Q&A with a financial expert. We also offer these webinars in Spanish. To attend, learn, and win register below: | ||||||

|

Annual Membership Meeting Notice

Save the Date | Tuesday, March 21, 2023

TCCU’s Annual Business Meeting will be held virtually and in-person, on March 21, 2023 at 6:30 PM. RSVP’s are required for either option. The in-person meeting will be held on the 3rd floor of the Tarrant County Plaza building at 200 Taylor Street, Fort Worth, Texas 76196.

RSVP to Monica Garcia by email or phone before noon on March 16, 2023. She is also your contact if you need more information or have questions. Monica Garcia: mgarcia@tccu-tx.com 817.884.1470 x 140.

2022 TCCU’s Annual Report

2022 Annual Meeting Minutes

Important News Regarding Credit & Debit Card Plastics

Due to some recent and unprecedented events at our card facility, debit and credit cards have been taking longer than anticipated for production and shipping. These events have impacted multiple credit unions across the United States, so we are not alone in these present circumstances.

If you recently ordered a new debit or credit card, or have a card nearing its expiration date and you have not received your replacement yet, please know that our processor is working around the clock to get your new card in your hands as soon as possible.

If the debit card you are waiting on IS A RENEWAL, you can load the current card number into a Digital Wallet (Apple, Google or Samsung Pay) and continue to use the card regardless of the expiration date.

For those needing a debit card in the interim, we do offer reloadable General Purpose Reloadable (GPR) cards at no cost, and they are available at any one of our 4 branch locations.

If you have any questions or need assistance while you wait, please contact us.

2022

Free BALANCE Financial Webinars

Our free BALANCE webinars for December, January, and February. Our webinars are open to everyone and packed with useful information. Just make sure to reserve your virtual seat.

|

DECEMBER — PLANNING FOR MONEY MILESTONES There are many important financial milestones for consumers in their 20s and 30s. To help prepare today’s young adults for a positive financial future—without sacrificing fun—we take a realistic approach to managing finances. We’ll cover SMART goals, getting financially organized, building a budget, controlling expenses, wiping out debt, and much more! Session 1: Tuesday, December 13, 2022 Time: 10:30 a.m. – 11:30 a.m. (PST) Share link: bit.ly/Planning4MoneyMilestones Session 2: Thursday, December 22, 2022 Time: 5:30 p.m. – 6:30 p.m. (PST) Share link: bit.ly/Planning4MoneyMilestones |

|

|

JANUARY — BASICS OF PERSONAL FINANCE From managing daily expenses to investing for retirement, this session helps participants set personal finance goals, learn the basics of smart money management, and build a solid financial foundation for the future. Session 1: Tuesday, January 10, 2023 Time: 10:30 a.m. – 11:30 a.m. (PST) Share link: bit.ly/BasicsofPersonalFin23 Session 2: Thursday, January 19, 2023 Time: 5:30 p.m. – 6:30 p.m. (PST) Share link: bit.ly/BasicsofPersonalFin23 |

|

|

FEBRUARY — USING CREDIT CARDS WISELY A credit card can be a valuable financial tool. However, before racking up big charges on multiple cards, participants should learn smart ways to handle their credit cards and take a disciplined approach. Session 1: Tuesday, February 14, 2023 Time: 10:30 a.m. – 11:30 a.m. (PST) Share link: bit.ly/UsingCCWisely23 Session 2: Thursday, February 23, 2023 Time: 5:30 p.m. – 6:30 p.m. (PST) Share link: bit.ly/UsingCCWisely23 |

|

Membership Drive Begins December 1st!

We’re looking for more great members, JUST LIKE YOU!

Beginning December 1st, we’re paying the first $1 for all new accounts opened – and BAM – once the account is opened, you’re entitled to take advantage of all TCCU products and services! This membership drive will end January 31st, so hurry up and send your friends and family our way – and share all the bang they can get for OUR BUCK!

One lucky member will win what we are calling, “A Big Ol Buc-ee’s Basket” – valued at $500!

Every member (new or existing) will receive one chance to win. Score one additional chance by following the instructions on our Facebook page. It’s gonna be fun!

October 6, 2022 - So Many Things!

Since our last secretive post in July, we rolled out our new brand (logo) AND our newly designed website. Then in September, we moved to a new debit card processor, and redesigned our debit cards. Members reaching debit card renewal this month, or members who place new card orders now, will be the first to see the new design, and will also enjoy the new contactless pay feature! Next up: Digital Wallets.

September 30, 2022 – Nominating Committee Names Candidates

July 12, 2022 – Exciting Changes Coming Soon

Hey…we have a secret! ???? We can’t tell you much more than that right now, but just know – it’s going to be good. Keep an eye on our social media. All will be revealed in time!

June 23, 2022 – Arlington Branch Update

As we prepare for closing the Arlington branch and begin transitioning staff to our other branches, we will close at 3:30 PM on June 30th, the final day at that location.

April 1, 2022 – Arlington Branch Set to Close June 30, 2022

The financial services world is ever-changing. As your credit union, we also have to make changes when it is in the best interest of our members’ money. Over the past several years, there’s been a considerable decline in walk-in traffic, particularly in the Arlington branch. The majority of our members who use the Arlington branch have shifted their banking habits to a more digital experience. Members have come to expect the best and easiest banking experience and we’ve worked hard to deliver that experience with our digital and mobile services. To continue to deliver better rates and lower fees, as well as continuing to offer state-of-the-art banking products, we have decided to redirect these resources to better benefit all members and will be closing the Arlington branch permanently on June 30, 2022. The closest surcharge free ATM is just .2 miles from the Arlington branch, and the nearest Shared Branch location is just 1.9 miles from the Arlington branch. TCCU members have access to thousands of fee-free CO-OP ATMs and Shared Branch locations across the country, in addition to our other TCCU branch locations. The staff at the Arlington branch will remain part of the TCCU team at our other branch locations. We remain strong and sound, and we’re pleased to be your financial service partner. We look forward to serving your financial needs for many years to come.

March 21, 2022 – MoneyPass ATM Network

Effective August 1, 2022, TCCU will no longer have an affiliation with the MoneyPass ATM network. As the transition takes place, MoneyPass ATM transactions made on or after July 18, 2022 and through July 31, 2002, may be charged standard surcharge fees. Beginning August 1st, standard surcharge fees will begin for all MoneyPass ATM transactions. Our affiliation with the CO-OP Shared ATM Network remains unchanged and will continue to allow ATM withdrawals for TCCU members surcharge-free.

February 7, 2022 – TCCU's Annual (Virtual) Business Meeting Date Set

TCCU is committed to ensuring the safety and well-being of our members, staff, and partners. In doing so, we continue to take precautions due to the coronavirus. As a result, TCCU’s 2022 Annual Business Meeting will be held VIRTUALLY via Zoom. Members may obtain log-in credentials to join this virtual, business-only meeting by emailing Monica Garcia by noon on 3/24/2022. If you have questions or need more information, you may contact her by phone (817.884.1470 x 140) or email.

January 26, 2022 – $500 Winners

The new year started off really nice for two TCCU members. Julia S. and M. Teresa L., both won $500 in the most recent Save to Win monthly drawings. Julia won at the National level, and M. Teresa won in the Texas/Arkansas drawing. Congratulations to both!

2021

October 19, 2021 – The Lake Worth branch will close daily from 1:30pm to 2:30pm

Effective November 1, 2021, the Lake Worth branch will close daily from 1:30 to 2:30 for lunch, as do the Hurst, Downtown and Arlington branch locations. The volume of in-person transactions has dropped considerably at our branches since the onset of COVID. In turn, we’ve experienced increased usage of our online and mobile services, so the need for hiring additional staff to cover lunch periods is not necessary at this time. For in-person transactions during those hours, the Plaza location is open as well as multiple Shared Branch locations.

October 19, 2021 – US Mail Delays

The United States Postal Service (USPS) made recent changes to USPS First-Class Delivery standards, effective October 1, 2021. The three-day delivery standard for first-class mail may now take up to 5 days to reach its destination. (And maybe even longer with current pandemic complications) This includes payments you send to us via check, or even some payments processed through another institution’s online bill pay system. Be aware of these delays and regularly monitor your payment activity. This may also affect delays in the mail you receive from TCCU, such as notices, mailed account statements, checks and debit card plastics.

Additionally, these delays are impacting payments being mailed to make TCCU Mastercard payments. As a reminder, the new mailing address for Mastercard payments is: MasterCard, P. O. Box 660493, Dallas, TX 75266-0493. If you use a bill-pay service, like ePay, update the payment address there as well.

Helpful Hints:

- Mail your payments a few days earlier

- Switch to eStatements

- Deposit checks using the mobile app

- Make TCCU payments by calling us, or in eBanking by selecting Transfers and following the steps

- Contact us and we can make recommendations to avoid payment delays, specific to your situation

October 1, 2021 – The Nominating Committee Appointees

The Nominating Committee appointed by TCCU’s Board of Directors, has submitted incumbent Robert Carter, and Associate Director, Travis Yarborough, for election to the Board of Directors for 3-year terms. Incumbent Steve Sparks is not seeking re-election.

September 10, 2021 – We NEVER Initiate Text Messages

A member reported receiving this text message from TCCU today. We NEVER initiate or send text messages regarding lending rates, or to make special offers.

If you should ever receive a text that appears to be from TCCU, call and report it to us immediately, as this member did.

July 14, 2021 – Advance Child Tax Credit Payments

The IRS has begun issuing the Advance Child Tax Credit Payments. These payments are posted to recipients’ accounts as soon as they are received. For eligibility and other questions regarding Advance Child Tax Credit Payments, visit the IRS website by clicking here. You can also read more information here.

June 18, 2021 Mastercard Upgrade Coming

We are gearing up to bring a new and improved credit card experience to our members this fall. New cards, with a new look AND with the contactless payment feature we all want. Watch our website and your email for updates and important information.

March 8, 2021 – Apple iOS 14.5 and TCCU's Mobile Banking App

Apple has released the third public beta of iOS 14.5. Because this release is still in beta, TCCU’s Mobile Banking App is not yet compatible with this release. If you have installed iOS 14.5, you will need to revert to iOS 14.4 to access your accounts via TCCU’s Mobile Banking App. If you need help reverting to iOS 14.4, contact Apple directly.

March 3, 2021 – TCCU's President & CEO Chairs New Small Credit Union Support Organization

TCCU’s President & CEO, Lily Newfarmer, along with twelve other female CEOs of small credit unions across the United States ($300 million and under), recently launched the Credit Union Women’s Leadership Alliance (CUWLA). This collaboration offers various forms of support to female CEOs of small credit unions nationwide. You can read more about it here.

Questions about our products and services? Give us a call at 817-884-1470.