News & Notices

Join Our Email List For TCCU news and important notifications.

2026

Urgent App Update Required

Older versions will no longer work after this date, and you will lose all app features until it is updated. To avoid service interruptions in the future, you might consider opting for automatic updates.

2026 Annual Meeting Date Set

The 2026 TCCU Annual Meeting is scheduled for Wednesday, March 25, 2026, at 5:00 PM.

This year’s business meeting will be offered both in‑person and virtually.

RSVP is required for both attendance options.

To reserve your spot, please contact Monica Garcia:

- Phone: 817‑884‑1470 ext. 140

- Email: [email protected]

2025

TCCU Nominating Committee Names Director Candidates

November 24th Deadline for Submitting Additional Nominees

The Nominating Committee appointed by TCCU’s Board of Directors, has submitted incumbent Directors Judy McDonald & Kylie Giancotti, for election to the Board of Directors for 3-year terms.

If you wish to nominate a candidate, you must make arrangements to pick up a petition packet by contacting Monica Garcia at 817-884-1470, ext. 140, on or after October 6, 2025, Monday – Friday 9:00am – 4:00pm. The petition packet may be picked up at the credit union’s main office at Tarrant County Plaza, located at 200 Taylor Street, Suite 215. Upon the return of the completed petition packet, a member of TCCU management must validate the petition. The petition must be signed by 1% of the membership. Those members must be in good standing with the credit union, and age 18 or older. Completed petition packets must be submitted to the credit union’s main office at Tarrant County Plaza no later than November 24, 2025. The nominee must submit a signed statement, along with the petition, that he or she is agreeable to the nomination and will serve if elected.

Downtown (Admin) Branch to Close 9/30/25

As more of our members choose digital and mobile banking, we’ve made the decision to close the Downtown branch location at 100 E. Weatherford Street, in the G.K. Maenius Administration Building – as of September 30, 2025.

As always, personal service is still a priority. Our full-service downtown branch located just three blocks away in the Tarrant Plaza building at 200 Taylor Street, will continue to be available to serve you in person. And for everyday banking needs, we’re keeping the ATM at the downtown/GK Maenius Administration Building, so you’ll still have easy access to cash.

We’re grateful for your trust and look forward to continuing to serve you — downtown at Plaza, at any of our other branch locations, or through our digital services whenever you need us.

My TCCU Cards App - Important Update

To ensure uninterrupted security and functionality of the My TCCU Cards app, you must update to version 45 or newer by August 26, 2025.

If the update isn’t completed, it will cause a loss of functionality and the app will stop working.

If you have automatic updates turned on, no action should be needed.

Read over the FAQ’s below and reach out if you have additional questions.

Changes to Shared Branching Coming May 1st

Effective May 1, 2025, when using a Shared Branch outside of your state, you will be asked to verify your identity before you can make withdrawal transactions. Your identity will be verified using IDCheck, taking the following steps:

- Scan the QR code with your smart device or visit verify.coop.org.

- Select Tarrant County’s Credit Union from the drop-down list

- Enter your member # and the last 4 digits of your social security number

- Upload a photo of your ID and take a selfie

- Show your one-time-password to the teller

These changes apply to out of state transactions if your license was issued in the State of Texas.

When using in-state shared branching (with Texas ID) , you will be asked to provide our name (Tarrant County’s Credit Union), a valid photo-ID (Driver’s license or equivalent), the last 4 of your social security number and your Tarrant County’s Credit Union account number.

These requirements keep your accounts safe and your ID protected. Please reach out if you have questions.

Free Medicare Webinar - April 29

We’re hosting a free Medicare Webinar on Tuesday, April 29th at Noon (CST) via Zoom, with Jason Checketts of Insurance Professionals of AZ.

Register now and learn key information on the Medicare topic, so that you can make choices best suited to your future needs.

Here is the registration link: https://us02web.zoom.us/webinar/register/WN_pKfFR3IeS6SAysY5mK5F_A

Free Retirement Webinar | Wednesday, February 19th (Recorded Session Avail)

Planning for retirement is a lot like planning for a trip. Where do you want to go? How and when do you want to get there? How much time and money will you spend upon arrival? What accommodations will you need and what experiences matter the most to you?

Like unexpected flight delays and lost luggage, market volatility, high health care costs, and inflation can leave you stranded. You need a detailed plan for your retirement journey.

This interactive presentation will provide an overview of:

- Three stages of retirement savings

- Three stages of retirement considerations

- Accumulation strategies

- 401(k) and 457 plans

- Legacy possibilities

- Tax-deferral options

Register today to find out how you can align your assets with your aspirations!

Annual Business Meeting Date Set

This year’s annual business meeting is set for Thursday, March 27, 2025, at 6:30 pm, and will be held in-person as well as virtually. RSVPs are required for both; call Monica Garcia at 817-884-1470 x 140, or email her at [email protected], by noon on 3/21/2025. The in-person meeting will be held on the 3rd floor of the Tarrant County Plaza Building. We hope to see you there!

Free Estate Planning Webinar Set for January 15

If you missed it, here’s the recorded version: https://attendee.gotowebinar.com/recording/8417963721502662570

eBanking Enhanced Security Feature Coming February 13th

Protecting your personal information is always our top priority. We’re excited to let you know that we’re adding another layer of protection to online & mobile banking.

Starting February 13, 2025, when you log into online banking, you’ll be prompted to enroll in the new system. You’ll need to answer 5 security questions. Once enrolled, the next time you log in, you’ll receive a 6-digit code via text or voice message to your phone. You’ll simply enter that code to complete your login. This replaces the current security questions, and the new feature is also available in the mobile app.

To ensure a smooth transition, please verify that we have your current cell phone number on file. You can do this by logging into eBanking on your desktop before February 13th, and updating your phone number under the Settings tab and selecting the Phone Number field. Once you’ve entered the correct number, Save it.

If you find that you need help, please reach out to us and we will be happy to assist you.

2024

Medicare Open Enrollment Starts in October; Helpful Webinars Coming September 24/25

It’s estimated that 75% of all Medicare beneficiaries will be shopping for a new plan for 2025. If you’re one of them, you won’t want to miss these free educational Medicare webinars, designed to help you learn about the upcoming Medicare Annual Enrollment Period (AEP). These webinars will cover the things you can and can’t do during the enrollment period, as well as what you need to do to be prepared. ![]()

Insurance Professionals Group

480-331-7974

This is an educational event only. There is no obligation to enroll. This is not a solicitation, and no salesperson will call you based on your participation in this event. For accommodations of persons with special needs, call 480-331-7974 (TTY: 711).

Important Notice: New Account Openings

Please be advised that, effective immediately, new accounts will no longer be processed at our Downtown, Hurst and Lake Worth branches after 4:30 PM each day. This change does not apply to our Plaza location.

We appreciate your understanding and cooperation.

Critical My TCCU Cards Mobile App Update Needed

If you use the My TCCU Cards app to protect your TCCU debit and/or credit cards, we’ve been notified by the developer that you must update to version R37 or newer by August 5, 2024. If you do not process the update, you will lose all functionality of the app.

This upgrade is essential to enhance security features and protect against potential hacking. Older versions of the app will be discontinued to ensure your information remains secure.

If you do not have automatic updates enabled, visit the app store on your device and update the app to the most recent version. Future mobile releases will alert you directly with an in-app notification.

If you don’t yet use the app, we encourage you to do so. Click here for more information on the My TCCU Cards app. Reach out to us if you have any questions regarding this important security upgrade.

English & Spanish Communications

Marketing and member-communications from the credit union will now be offered in English and Spanish for the convenience of our members and the diverse community we serve.

BALANCE Webinar for the Win Sweepstakes

Contestants (you) are getting an extra incentive to attend these free, educational webinars. One lucky attendee will win the $1,000 GRAND PRIZE!

The rules are simple. To enter, you must register and attend one of the free webinars held in February, March or April (and stay for the whole thing). Webinars are live, online sessions that let people learn from and interact with an expert on today’s most popular financial topics.

(Pro tip: Attending additional webinars earns you extra entries into the contest.)

February, “Solving the Mystery of Credit Reports”

February 13th and 22nd

Register: bity/SolvingMysteryofCreditReports2024.l

March, “Saving with Purpose”

March 12th and 21st

Register: bit.ly/SavingwithPurpose2024

April, “Teens and Money”

April 9th and 18th

Register: bit.ly/TeensandMoney2024

2024 Annual Meeting Date Set

Thursday, March 28, 2024 | 6:30 P.M.

Thursday, March 28th is the date for this year’s Annual Business Meeting. We are offering both in-person and virtual options for members to attend this business meeting. Please RSVP by email to Monica Garcia or call her before noon on 3/22/2024. RSVP’s are required for either option. Monica Garcia | [email protected] 817-884-1470 x 140

If you plan to join us in person, the meeting will be held on the 3rd floor of the Tarrant County Plaza Building. If you have any questions or need additional information, please don’t hesitate to get in touch with Monica. We look forward to seeing you there!

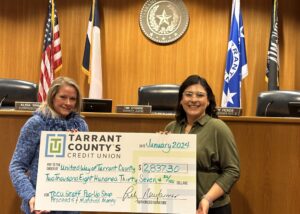

TCCU Pop-Up Shop Nets Generous Donation

Leading up to the Christmas holidays, TCCU staff held several craft Pop-Up shops to raise money for the United Way of Tarrant County. All items in the shop were handmade, either by a staff member, or by someone in their immediate family. Sellers donated 10% of all sales, and TCCU matched all total sales 100%. Including generous donations, we were able to present a check to the United Way of Tarrant County in the amount of $2837.30 on Tuesday, January16, 2024.

Free Tax Filing Assistance

Update | April 11, 2024: We are no longer accepting appointments for this tax season. See you next year!

IRS-Certified TCCU staff volunteers will be providing FREE tax preparation through VITA, weekdays – by appointment only, at our Tarrant Plaza branch, located at 200 Taylor Street, Suite 215. VITA is a Volunteer Income Tax Assistance Program.

VITA offers free basic tax return preparation to qualified individuals. VITA at this location is available to TCCU members and non-members, alike.

This tax service is for people who generally make $64,000 or less, so please see a professional preparer for assistance with complicated returns.

TCCU does not offer tax advice.

Introducing Medicare Plan Assistance; Free Educational Webinar

480-331-7974

Choosing the right Medicare coverage is essential to ensure that you have the necessary healthcare support for your individual requirements. But knowing what plan to choose can be overwhelming.

TCCU has partnered with Insurance Professionals Group to bring you access to expert advice and guidance on navigating the intricacies of Medicare insurance plans.

These professionals have the expertise to guide you through a step-by-step process of selecting the best Medicare plan, which can help you save money and get comprehensive coverage that meets your needs.

You’re invited to attend a free educational Medicare webinar to help you learn about your Medicare options and determine what is important when enrolling in Medicare. Whether you are turning 65 or looking ahead to your Medicare options, we will highlight important information that will help you find the best coverage. Choose a date below and register today!

February 21, 2024

1:00 PM CST

February 22, 2024

6:00 PM CST

This is an educational event only. There is no obligation to enroll. This is not a solicitation, and no salesperson will call you based on your participation in this event. For accommodations of persons with special needs, call 480-331-7974 (TTY: 711).

2023

Did You Miss the Webinar?

If you missed the Life Stage Investing webinar held a couple of weeks ago, we have the recorded session available for you to view right here; https://www.youtube.com/watch?v=oYGAZYvghYw

Life Stage Investing webinar - Back by Popular Demand

Free – Life Stage Investing webinar is coming soon!

Speaker: Tim Mangus, Financial Advisor

Wednesday, November 15, 2023

2:00 PM, Via ZOOM

At every life stage, you have competing priorities for how to spend your money. In your early working years, you may be focused on paying down college debt or saving for a mortgage. In the middle of your career, you may be saving for a child’s college education or remodeling your home. And, as you near retirement, you may be more concerned about how to make your savings, Social Security, and other sources of income last for 20 to 30 years.

Wherever you are on your retirement path, this informative, interactive presentation will provide information on how to:

- Save for the long term;

- Identify sources of retirement income and gaps;

- Understand your Social Security options; and

- Explain health care decisions you’ll need to make when you become eligible for Medicare.

Register today to find out some ways you can align your assets with your aspirations.

TCCU membership is not required. We hope you can join us!

TCCU Nominating Committee Names Candidates

November 22nd Deadline for Submitting Additional Nominees

The Nominating Committee appointed by TCCU’s Board of Directors, has submitted incumbents, Alan Thomas, Craig Maxwell, and Tom Spencer, for election to the Board of Directors for 3-year terms.

If you wish to nominate a candidate, you must make arrangements to pick up a petition packet by contacting Monica Garcia at 817-884-1470 x 140, on or after October 9th, 2023. The petition packet may be picked up at the credit union’s main office at Tarrant County Plaza, located at 200 Taylor Street, Suite 215. Upon the return of the completed petition packet, a member of TCCU management must validate the petition. The petition must be signed by 1% of the voting membership. Those members must be in good standing with the credit union, and age 18 or older. Completed petition packets must be submitted to the credit union’s main office at Tarrant County Plaza no later than November 22, 2023. The nominee must submit a signed statement, along with the petition packet, that he or she is agreeable to the nomination and will serve if elected.

Wills & Trusts Virtual Workshops - August 9th & 16th

Join Tarrant County’s Credit Union & PFG Wills & Trusts Document Preparation as we introduce estate planning services to our members.

We invite you to attend the upcoming free, no-obligation virtual workshop designed to help you prepare for the unexpected.

Have you thought about:

- What if something happens to me? Are my loved ones protected?

- Should I have a plan in place for the future?

- Who will take care of my children if something happens to me?

- Who will make health care or financial decisions if I’m unable to do so?

- Do I need to set up a WILL or TRUST? Where do I start?

We know that planning for the unexpected is more important than ever, so we are here to help provide the resources you need.

*UPDATE* We will offer additional workshops in the near future. Meanwhile, you may listen to the recordings from the August 9th and August 16th sessions here:

|

8/9/2023 |

https://attendee.gotowebinar.com/recording/4139777160348157022 |

|

8/16/2023 |

https://attendee.gotowebinar.com/recording/690244146311114588 |

PFG Wills & Trusts Document Preparation operates under the direction and supervision of a Phocus Law estate planning attorney licensed in the states of Arizona and California (AZ Bar No. 028285, CA Bar No. 329214). Webinars and presentations are for educational purposes only and do not constitute legal advice. Participants do not have an attorney-client relationship with presenters without additional written confirmation. PFG Wills & Trusts Document Preparation, Phocus Law and Tarrant’s County Credit Union are separate entities. Estate Planning Services are not insured by the NCUA and have No Credit Union guarantee.

An Exciting New Checking Account Product is Here

For many years we’ve looked for a checking account product that would offer true value to our members, and we finally found it! Beginning July 5th, Standard PLUS Checking becomes TCCU’ s featured checking account. This new account is loaded with valuable benefits designed to save you money on everything from identity theft services to health services and even cell phone protection.

You’ll still get the free benefits you’re accustomed to, like:

- Complimentary online banking

- Complimentary e-statements

- Complimentary debit MasterCard®

- No fee for withdrawals at TCCU ATMs

- Thousands of fee-free ATMs nationwide

In addition, you’ll receive all of these NEW benefits and services for as low as $6 a month:

- Identity theft protection with credit file monitoring

- Cell phone protection that can replace coverage from your carrier

- Travel and leisure discounts

- Telehealth service with zero copays

- Shopping rewards

- Health discount savings (vision, prescription and dental)

- Up to $5,000 of 24-hour accidental death and dismemberment insurance

All of your account information and the way you access your account stays the same. The monthly service fee will begin August 1, 2023. The fee starts at $10 a month, but you’ll get one dollar off for each of the following:

- You’ve been a TCCU member 2+ years

- You have direct deposit into your Standard PLUS Checking account

- You have an active debit card on your Standard PLUS Checking account

- You’re enrolled in eBanking

Benefits like the cell phone protection and Telehealth more than pay for the small monthly fee on this account. (It’s less than 2 drinks from Starbs!) If you’d prefer to stay in your current checking account product please call or text us at 817-884-1470, and we’ll find the account that better suits your needs.

Your Money is Safe with TCCU

In the wake of the two recent bank failures in the U.S., we want to assure you that your deposits are safe at Tarrant County’s Credit Union.

Not only is TCCU sound and well capitalized, we reinvest member deposits into our communities via consumer and small business loans. We don’t reinvest member deposits in risky, long-term investments in search of a higher rate.

Tarrant County’s Credit Union is federally insured. Each credit union member has at least $250,000 in total coverage through the National Credit Union Share Insurance Fund, administered by the NCUA. The share insurance fund was created by Congress to insure members’ deposits in federally insured credit unions.

- Additionally, all joint owner accounts are combined and insured up to $250,000.

- The Share Insurance Fund also separately protects members’ IRA and KEOGH retirement accounts up to $250,000 and provides additional coverage for members’ trust accounts (accounts with Payable on Death beneficiaries).

- The Share Insurance Fund has the backing of the full faith and credit of the United States.

- Credit Union members have never lost even a penny of insured savings at a federally insured credit union.

There are multiple ways in which to structure your account to increase the insurance coverage on your deposits. Our Member Service Representatives can help you maximize your insurance coverage. If you have questions or are concerned about the share insurance on your account, please call us at 817.884.1470.

We’re grateful to be able to serve the members of Tarrant County’s Credit Union and appreciate your continued support and confidence. In the wake of these unsettling times, it’s crucial to have a trusted and valued partner looking out for your best interest.

Working together, toward common goals, will ensure our members’ and our Credit Union’s success for years to come.

Lily Newfarmer, I-CUDE, SCMS

President and CEO

Tarrant County’s Credit Union

5th Annual Webinar for the Win Sweepstakes

| The 5th Annual Webinar for the Win Sweepstakes is here! Attend one of our BALANCE webinars and enter for a chance to win $1,000! Our webinars are live, interactive, and include a Q&A with a financial expert. We also offer these webinars in Spanish. To attend, learn, and win register below: | ||||||

|

Annual Membership Meeting Notice

Save the Date | Tuesday, March 21, 2023

TCCU’s Annual Business Meeting will be held virtually and in-person, on March 21, 2023 at 6:30 PM. RSVP’s are required for either option. The in-person meeting will be held on the 3rd floor of the Tarrant County Plaza building at 200 Taylor Street, Fort Worth, Texas 76196.

RSVP to Monica Garcia by email or phone before noon on March 16, 2023. She is also your contact if you need more information or have questions. Monica Garcia: [email protected] 817.884.1470 x 140.

2022 TCCU’s Annual Report

2022 Annual Meeting Minutes

Important News Regarding Credit & Debit Card Plastics

Due to some recent and unprecedented events at our card facility, debit and credit cards have been taking longer than anticipated for production and shipping. These events have impacted multiple credit unions across the United States, so we are not alone in these present circumstances.

If you recently ordered a new debit or credit card, or have a card nearing its expiration date and you have not received your replacement yet, please know that our processor is working around the clock to get your new card in your hands as soon as possible.

If the debit card you are waiting on IS A RENEWAL, you can load the current card number into a Digital Wallet (Apple, Google or Samsung Pay) and continue to use the card regardless of the expiration date.

For those needing a debit card in the interim, we do offer reloadable General Purpose Reloadable (GPR) cards at no cost, and they are available at any one of our 4 branch locations.

If you have any questions or need assistance while you wait, please contact us.

Questions about our products and services? Give us a call at 817-884-1470.